W.D. Gann, a financial advisor, and trader in the stock and commodity markets during the early 20th century, introduced the Square of Nine as a tool for trading and forecasting in the 1920s.

He shared the methods for utilizing this tool through his private financial seminars and later in his written trading courses.

This book is dedicated to unveiling every major technique for forecasting using the Square of Nine.

Throughout his teachings, W.D. Gann referred to the Square of Nine by different names, such as the “Odd Square” and the “Master Price and Time Calculator.”

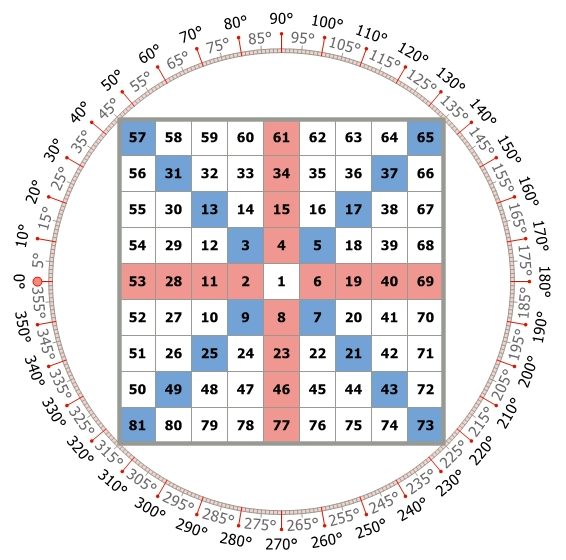

However, for the sake of consistency, this book solely employs the name “Square of Nine.” The above image showcased on the following page, displays a fundamental Square of Nine.

It contains two sets of numbers:

- one set encircles the square’s outer perimeter,

- while the second set appears on the square’s face.

W.D. Gann positioned the 0° mark of the outer circle at the center-left and counted the degrees in a counter-clockwise direction.

On the other hand, the numbers on the face of the square progress in a clockwise manner. We will analyze Square of Nine from William Gann’s perspective in more detail shortly in the next posts.