October: This is one of the peculiarly dangerous months to speculate in stocks. The others are July, January, September, April, November, May, March, June, December, August, and February.

Mark Twain, Pudd’nhead Wilson

Who was William Gann?

On a warm June 6th in 1878, a remarkable individual named William Delbert Gann was born in Lufkin, Texas. Lufkin, a town nestled between Houston and Texarkana, sat in the heart of the cotton country.

Gann’s parents, Sam H. and Susan R. Gann, immigrants to Texas from the British Isles, lived on a cotton ranch near Lufkin, right by the fertile banks of the Neches River. He grew up around the cotton warehouses in Angelina County where cotton was king.

W. D. Gann was raised in a very strict Methodist church family. His mother, a very religious person, encouraged him to read the Bible at a very early age, and in fact, wanted him to become a minister.

Gann was not sure he wanted to become a minister, but studying the Bible was certainly easier than working in the cotton fields, as was his father’s wish. He attended church every Sunday with his parents and he listened to the sermons. There, He found his interpretation of the Bible scriptures to differ from the minister’s.

In the Bible, he discovered time cycles, repetition of important numbers, and references to the wise men following the stars. Also, that it was written in a veiled language which made interpreting the real meaning difficult. By the age of 21 Gann had nearly memorized the Bible.

During his school years, Gann excelled in mathematics and was generally called a gifted mathematician. His tremendous appetite for knowledge and his open-minded attitude led him into many different fields of study that eventually resulted in discoveries in the markets that would otherwise have been overlooked. He completed high school at a time when most children were only able to attend school through the third or fourth grade.

As a teenager, Gann liked to be called W. D., and he used these initials for the rest of his life. W. D. pestered his parents until they relented and signed a minor release form that he needed to obtain a job.

His first job was that of a News Butcher on the passenger train between Texarkana and Tyler, Texas. This job required him to be quick-witted, aggressive, and able to deal with all kinds of people.

During his teen years, he worked in the cotton warehouses in Lufkin and Texarkana, Texas. While working in the cotton warehouse, he was introduced to commodity trading.

In 1902, at age 24, W. D. Gann made his first commodity trade in cotton, the market he knew best. The small profit from that trade marked the beginning of what was to become one of the most remarkable and legendary careers the speculative markets have ever known.

Over the next 53 years, Gann took over $50,000,000 from the markets. It has been reported by a man who worked for Gann the last eight years of Gann’s life, that approximately 1/3 of the money he made was for himself and the other 2/3 was for the accounts he supervised for clients.

From that very first trade, it is believed Gann was using principles and techniques he continued using throughout his trading career.

The notations on some of his early charts substantiated this belief. As time progressed, his trading methods were refined.

In 1906 W. D. went to Oklahoma City. He worked as a broker for a brokerage firm, trading for himself while handling large accounts for clients. He studied the cause of success and failure in the speculation of other traders. He found that over 90% of traders who enter the markets without knowledge and study usually lose in the end.

Gann also lost a significant amount of money and admitted his trading was based on hope, greed, and fear.

Later on, in his books and courses, he cautioned all traders about these emotions. Early on, Gann began to note the periodical recurrence of rise and fall in stocks and commodities. This led him to conclude that natural law was the basis of market movements.

He then devoted ten years to the study of natural law as applicable to speculative markets. During that time he traveled to England, Egypt, and India to gain knowledge in ancient mathematics and astrology. In the British Museum in England, he conducted extensive research on market cycles. In an Egyptian pyramid, it is believed he found the basic construction of what was to become known as his Square of 9 Chart.

After exhaustive research and investigation of the known sciences, he discovered the Law of Vibration enabled him to accurately determine the exact prices to which stocks or commodities would trade within a given time, and that each stock or commodity had its own rate of vibration.

At age 27, Gann was a well-known name in the Southwest. His views on the analysis of cotton prices were so well respected that a Texarkana newspaper, The Daily Texarkanian, ran a story on Gann’s cotton predictions.

In 1908, at age 30, Gann moved to New York and opened his own brokerage office at 18 Broadway. He began testing his theories and techniques in the market.

On August 8, 1908, he made one of his greatest mathematical discoveries for predicting the trend of stocks and commodities. This was “The Master Time Factor.”

Within a year, it became clear to others that his success was based on more than just luck. No one researched time cycles as extensively as Gann. His charts show the cycles with which he worked, went back to history’s beginning, and bore no resemblance to other researchers’ time cycle studies.

In October 1909, Richard D. Wyckoff, Owner and Editor of The Ticker and Investment Digest asked Gann for an interview to document his trading ability for one month.

The interview was granted, and Gann’s trades were monitored for 25 market days during the month of October in the presence of a Ticker representative. At that time the markets also traded on Saturday.

Gann made 286 trades in various stocks, both long and short. There were 264 trades that resulted in profits and 22 in losses. 92.3% of the trades were profitable. The capital used doubled ten times resulting in a 1000% gain on his original investment during those 25 trading days.

What makes this even more phenomenal is that Gann did this with an average time between each trade of about twenty minutes.

In one day Gann made 16 trades in the same stock, 8 of which were in either the top eighth or the bottom eighth of that particular swing.

Such a performance is unparalleled in the history of Wall Street.

As stated by James R. Keene, the famous speculator of that era, “The man who is right 6 times out of 10 will make his fortune.”

It seems a foregone conclusion that Gann was picking tops and bottoms with a high degree of accuracy. At this point in time, in 1909, he was only 31 years of age, so whatever methods he was using had already been discovered. This biographer believes that after his sensational performance, Gann regretted having granted the interview, as it was stated in the printed article that he did not know the results were to be published. When the article was printed in The Ticker Investment Digest, Gann was besieged with people asking how he was able to pick tops and bottoms as he had demonstrated.

His only answer to them was he used The Law of Vibration to make all his calculations. At this conjuncture, there were only two choices:

- To give away his secret discoveries and risk destroying the markets, or

- To detract from his method of picking tops and bottoms by writing books and courses about mechanical trading systems, the use of geometrical angles, the use of Time and Price Charts, such as the Octagon Chart (Square of 9), Master 12 Chart (Square of 144), Hexagon Chart (the cube), Square of 90, Square of 52, 360 Degree Circle Chart, and many other trading techniques.

If Gann had continued trading using only his method of picking tops and bottoms, without a doubt he would have become one of the wealthiest men in the world, and in so doing would have attracted too much attention. He would have been asked too many questions by traders and would have been compelled to explain.

However, at certain times, he probably used his method to his advantage. Gann had a profound understanding of natural law, so rather than place himself in an embarrassing situation, he chose to trade using his mechanical systems and other techniques he had developed. Also, having more capital than was required for a good living was not important to him, as he was more interested in the knowledge possessed by ancient civilizations and the occult sciences.

Gann understood how the Laws of Nature controlled human beings and, therefore, he understood the markets, because the markets are nothing more than an expression of the actions of human beings.

The two previous paragraphs are my belief. You may agree or disagree, but before you arrive at a conclusion, carefully study Gann’s 1909 trading demonstration. He made 286 trades in 25 days, which is 11 trades per day. To do this, you must pick the tops and bottoms on a short intraday time period.

If what I believe is true, it is very sad to think that a genius individual such as W. D. Gann, had to disguise the truth throughout his life, with a smoke screen of many trading methods and techniques.

In 1918 his office address in New York was 81 New Street and in the early 1920’s was at 49 Broadway. Over the years, Gann maintained several offices in New York all located on Wall Street with the address numbers of 78, 80, 82, 88, 91, 93, and 99.

At the height of Gann’s career, he employed 35 individuals who made charts of all kinds, did analytical research at his direction, and performed many duties involved with his various publications and services.

The name of one of his businesses was W. D. Gann Scientific Service, Inc., and the other, initiated in 1919, was W. D Gann Research, Inc.

The firms published the following Supply and Demand Letters: Daily Stock Letter, Tri-Weekly Stock Letter, Weekly Stock Letter, Daily Commodity Letter, Tri-Weekly Commodity Letter, and Weekly Commodity Letter. Telegraph Service was all offered as follows: Daily Telegraph Service on Stocks, Daily Telegraph Service on Cotton, Daily Telegraph Service on Grain, and Telegrams on Important Changes Only, on Stocks or Commodities. Published under Annual Forecasts were: Annual Stock Forecast, Annual Cotton Forecast, Annual Grain Forecast, Annual Rubber Forecast, Annual Coffee, Sugar and Cocoa Forecast.

Supplements to all Forecasts were issued and mailed on the first of each month. Special Forecasts on stocks or other commodities were made on request. Also offered were daily, weekly, monthly, quarterly, and swing charts on stocks and commodities. Gann taught advanced courses of instruction entitled Master Forecasting Method, at a cost of $2,500, and New Mechanical Method and Trend Indicator, at a cost of $5,000, to those who want it for their own use and will not publish, sell, or teach it to others. It is too valuable to be spread broadcast.

The cost of these courses and personal instruction in today’s economics would be $25,000 to $50,000 or more.

As early as 1923, Gann offered a service entitled “The Busy-Man’s Service.” This was a service for professionals and businessmen where Gann supervised their trading accounts by advising them what and when to buy and sell. In later years the name of this service was changed to “Personal Service.”

The cost of this service was on a 1-month, 3 months, 6 months, or annual basis, or on a Part-of-Profit Plan where the monthly fee was smaller and Gann received 5% of the net profits. Under the Part-of-Profit Plan, it was required that a minimum of 100 shares be traded.

The clients were advised by telegram or letter.

An article in The Evening Telegram dated New York, Monday, March 5, 1923, used the words “prophet” and “mathematical seer” to describe Gann. It also stated his followers declared he was 85% correct in his forecasts. He predicted the election of Wilson and Harding using fortunate numbers and fortunate letters combined with cycles.

He predicted the abdication of the Kaiser and the end of the war to the exact date six months in advance. His predictions were based on mathematics. He stated if he had the data he would use algebra and geometry to tell exactly by the theory of cycles when a certain thing is going to occur again.

He further stated that there is no chance in nature because mathematical principles of the highest order lie at the foundation of all things. The article pointed out that Gann received calls every day from prominent persons asking him to cast their horoscope. It also said he told politicians whether or not they would be elected and solved problems for clergymen, bankers, and statesmen.

In another article in the Morning Telegraph, dated Sunday, December 17, 1922, the Financial Editor, Arthur Angy, stated that “W. D. Gann had scored another astounding hit in his 1922 stock forecast issued in December 1921, I found his 1921 forecast so remarkable that I secured a copy of his 1922 stock forecast to prove his claims for myself. And now, at the closing of the current year of 1922, it is but justice to say I am more than amazed by the result of Mr. Gann’s remarkable predictions based on pure science and mathematical calculations. ”

W. D. and his wife, Sadie H. Gann, had one son and three daughters born to their marriage. Their son, John L. Gann, was in partnership with his father for several years in the late 1930s and early 1940s, operating under the firm name of W. D. Gann & Son, Inc. Apparently, the two personalities were not always compatible, as their association was ended in the mid-1940s. This writer has been told one of their main differences concerned astrology, as John did not believe astrology had any effect on market movements or human behavior.

This probably upset W. D. as he knew well the effect of planetary motion on the markets and the individual. Following the association with his father, John served as a broker for many years for the firm Sulzbacher, Granger & Co. in New York City. It is believed that John passed away in 1984.

For many years Gann maintained a home in Scarsdale, New York, which was, at the time, the estate bedroom community for New York City.

In an article that appeared in the May 26, 1933, New York Daily Investment News, it was reported that Gann left New York in the first 1933 model Stinson Reliant airplane, piloted by Flinor Smith, a woman aviator, to conduct an extensive tour of the country analyzing cotton, wheat, and tobacco crops, and business conditions.

The airplane was equipped with navigation instruments, radio receiving equipment, and extra-large fuel tanks that gave a flying range of 750 miles. It was powered by a Lycoming engine and cruised at 135 miles per hour. Gann was the first Wall Street advisor to use an airplane for studying market conditions so he could advise clients much faster about changing market conditions. During his trip, he was a speaker to members of Kiwanis, Rotary, Chamber of Commerce, and other business organizations in various larger cities throughout the United States.

In 1935, Gann made an airplane trip to South America for studying crop conditions, and to gather information on the increase and production of cotton in Peru, Chili, Argentina, and Brazil. He logged 18,000 miles by air and another 1,000 miles by automobile.

In July of 1936, Gann purchased a specially built all-metal airplane, which he named “The Silver Star,” and used in making crop surveys. In July of 1939, he purchased a new Fairchild airplane for the same purpose.

Gann was a member of the Commodity Exchange, Inc. of New York, the New Orleans Cotton Exchange, the Rubber Exchange of New York, the Royal Economic Society of London, the American Economic Society, the Masonic Lodge, the Shrine, the Chicago Board of Trade, and was a devout Christian in the Methodist Church.

Gann had a winter home in Miami, Florida, and in the 1940’s moved there on a full-time basis. His office was at 820 S. W. 26th Road in Miami. While in Florida, he continued his advisory services as well as teaching his commodity and stock market courses, either in person or by mail.

By the late 1940’s he had a recommended list of Books For Sale that included the subjects of numerology, astrology, scientific, and miscellaneous. He was involved in real estate holdings and enjoyed large automobiles, especially Lincolns, which he purchased new yearly.

In 1954, after making several successful coffee and soybean trades, Gann purchased a fast express cruising boat that he named “The Coffee Bean.”

It was reported that Gann wore the same type of suit throughout his life and that his home was filled with items collected in his world travels. He vacationed often in South America. But, in the opinion of his peers, he did not live beyond his means.

W. D. Gann wrote some of the best books ever written on the stock and commodity markets. The following is a list of the books written by him and the year they were published:

- Speculation of a Profitable Profession

- The Truth of the Stock Tape

- The Tunnel Thru the Air

- Wall Street Stock Selector

- Stock Trend Detector Scientific Stock Forecasting

- How to Make Profits Trading in Puts and Calls

- Face Facts America. Looking Ahead to 1950

- How to Make Profits Trading in Commodities

- 45 years on Wall Street

- The Magic Word

- How to Make Profits Trading in Commodities

Gann was a prolific writer. His style of writing was unique. Readers of his books considered him to be a poor writer with limited use of the English language. Not so!

Upon methodic study of his work, the reader will discover in time the Gann method of teaching. He will inspire the reader to research everything from the origin of numbers to the musical scale and vibrations.

W. D. Gann, in my estimation, was a genius. He was born a Gemini with a high intellectual capacity, and a dual personality that caused him to be both genial and obstinate. He was a gifted mathematician, an expert chart reader, and had an extraordinary memory for figures.

Take away his science and he would beat the market on chart reading alone. One of Gann’s most important technical tools was his charts and no one kept up as many as he did. Gann’s charts encompassed 55 years, from 1900 to 1955. During this time thousands of daily, weekly, monthly, quarterly, yearly, and other various charts, were made with great care, each a work of art. He believed charting was an art and if you understood everything the chart was showing, it would aid in forecasting the next day, week, or month, price movements.

Gann was a workaholic, at times working 17 hours per day, 6 days per week. He was very demanding of those who worked with and for him, and expected the same effort from them that he himself put forth. He expected to issue instructions only once and did not feel it should be necessary to repeat them.

Gann was deeply analytical and studied the price actions of various stocks and commodities back through the years. He spent nine months in the British Museum working day and night researching stock and commodity prices and dates from 1820, and wheat prices and dates from 1200.

He also spent long hours and long days in the Astor Library in New York City researching stock and commodity markets. He was a student of numbers, number theory, progressions, and the progression of numbers. His trading system was based on natural law and mathematics. Since time progresses as the earth rotates on its axis and in its order, and time is measured by numbers and progression of numbers, and prices in their movement upward and downward are also measured in numbers, it is understandable why Gann had an intense interest in numbers, number theory, and mathematics.

A keen understanding of natural laws and their effect on mankind has a direct effect on the markets. The markets are only extensions or reflections of man’s actions.

In Gann’s time, there were no calculators. He used a slide rule and the various master charts he developed, such as the Square of 9, for his calculator. He kept an open mind to any trading ideas to achieve perfection. When making his forecasts, he used many methods to arrive at the time for a trend change, and all of them to confirm he was correct.

In his early trading, he made thousands of dollars. But, by listening to false rumors and other people’s ideas, he also lost thousands of dollars. In 1913 and again in 1919, he lost small fortunes when the brokerage firms he was trading with went bankrupt. One of these firms was Murray Mitchell and Company. In those days the client’s funds were not protected by exchange regulations in case of a failure, as they are today.

During this time, he was also involved in two bank failures. Regardless of these losses and misfortunes, he was always able to rely upon mathematical science to aid him in making a financial comeback. This is why Gann states that knowledge of the market is more important than money.

Today, people believe “times are different,” but Gann’s time saw its bull markets and panics in the stock market, bull markets, and panics, in the commodity market, wars, inflationary periods, depressions, bank closings, etc. In 1921 the rate of inflation was 100%.

Strikes were rampant, jobs impossible to find, and productivity at very low levels. The Great Depression of 1929 to 1932 and the outright confiscation of the citizen’s gold that was exchanged for printed money, left deep scars on the country and its citizens. W. D. Gann was avidly against the New Deal and Roosevelt’s creeping socialism.

Therefore, to learn from other people’s past experiences, people today should understand Gann’s famous quotation, “The future is but a repetition of the past, or as the Bible says, the thing that hath been, it is that which shall be; and that which is done, is that which shall be done; and there is no new thing under the Sun.”

Gann said, “The average man’s memory is too short. He only remembers what he wants to remember or what suits his hopes and fears. He depends too much on others and does not think for himself. Therefore, he should keep a record, graph, or picture of past market movements to remind him what has happened in the past can, and will, happen in the future. Panics will come and bull markets will follow just as long as the world stands and they are just as sure as the ebb and flow of the tides because it is the nature of man to overdo everything. He goes to the extreme when he gets hopeful and optimistic. When fear takes hold of him, he goes to the extreme in the other direction.”

The following is taken from 45 Years in Wall Street and is very good advice and very true in today’s world.

“Every man takes out of life just exactly according to what he puts in. We reap just what we sow. A man who pays with time and money for knowledge and continues to study and never gets to the point where he thinks he knows all there is to know, but realizes that he can still learn, is the man who will make a success in speculation or in investments. I am trying to tell you the truth and give you the benefit of over 45 years of operating in stocks and commodity markets and point out to you the weak points that will prevent you from meeting with disaster. Speculation can be made a profitable profession. Wall Street can be beaten and there is money operating in commodities and the stock market if you follow the rules and always realize that the unexpected can happen and be prepared for it.”

In How to Make Profits in Commodities —

Gann made the following comments regarding knowledge as he believed knowledge is power. All who read this should heed and always remember his advice.

“The difference between success and failure in trading in commodities is the difference between one man knowing and following fixed rules and the other man guessing. The man who guesses usually loses. Therefore, if you want to make a success and make profits, your object must be to know more; study all the time; never think that you know it all. I have been studying stocks and commodities for forty years, and I do not know it all yet. I expect to continue to learn something every year as long as I live. Observations, and keen comparisons of past market movements, will reveal what commodities are going to do in the future because the future is but a repetition of the past. Time spent in gaining knowledge is money in the bank. You can lose all the money you may accumulate or that you may inherit – that is if you have no knowledge of how to take care of it – but with knowledge you can take a small amount of money and make more after time spent gaining knowledge. A study of commodities will return rich rewards.”

Sometime in 1947, Gann sold W. D. Gann Research, Inc. to C. C. Loosli, a San Francisco attorney. He became disenchanted with the business and on February 14, 1948, W. D. Gann Research, Inc. was transferred to Mr. Joseph L. Lederer of St. Louis, Missouri. The office for W. D. Gann Research, Inc. was maintained at 82 Wall Street in New York until 1952. Then it was moved to Scarsdale, New York, and in 1956 relocated to St. Louis, Missouri, where its only business was that of investment adviser.

In 1950 in Miami, Florida, Gann and a partner, Ed Lambert, founded Lambert-Gann Publishing Co. Ed Lambert was an architect who designed the Inter-State Highway System in the greater Miami area Lambert Gann Publishing Co. published all Gann’s books and courses.

W. D. Gann passed away in the Methodist Hospital in Brooklyn, New York, on June 14, 1955, at the age of 77. He was survived by his wife, Sadie, three daughters, and a son. That day the world truly lost a market legend.

After Mr. Gann’s death in 1955, Ed Lambert continued to operate the business that included a chart service of updated Gann-style charts.

He was not as active in promoting Gann’s writings as when Gann was alive, so for the following twenty years, Gann’s work became quite obscure. In 1976 Bill and Nikki Jones of Pomeroy, Washington purchased Lambert-Gann Publishing Co. and the Gann copyrights. In the purchase were all of his personal research including thousands of his charts, papers, books, and writings he had collected through fifty years of trading and research. There were also tables and miscellaneous office furniture used by Gann. The largest Mayflower moving van available was required to transport this purchase to Pomeroy, Washington.

Following Billy Jones’ death in September 1989, Nikki Jones continues to operate Lambert Gann Publishing Co., carrying on the Gann tradition with the sale of his books and courses. In this biographer’s opinion, W. D. Gann was the greatest market researcher of all time. His trading career spanned more than a half-century. During that time he devoted his total life to market research and trading. He researched every possible aspect of natural laws in conjunction with variables of price and time in market movements.

This study became an obsession to find the cause and effect of market fluctuations, which he did. The trading techniques Gann developed work the same today as they did when he used them. His library contained volumes of books and manuscripts on harmonic waves, proportion, growth, gravity, electricity, nature, and natural phenomena. However, there were no books on open interest, volume, stocks, or commodities.

The only books and courses on commodities and stocks were his own.

He was a humble man who stated, at age 75, that he had not learned all there was to know, and yet, he knew more about the markets than any trader who ever lived.

There is an important lesson to be learned from the study of his life and his work. For those of you who have diligently studied his writings, you will understand my statements. Hopefully, for those of you who are not familiar with Gann, this writing will inspire you to begin.

Legends of William Gann

William D. Gann was a trader in the early 20th century. His abilities for profiting from the stock and commodity markets remain unchallenged. Gann’s methods of technical analysis for projecting both price and time targets are unique. Even today, his methods have yet to be fully duplicated.

His successes are legendary. Gann literally converted small accounts into fortunes, increasing their net balances by several hundred percent. There are numerous examples of his trading successes, among which are these:

- 1908 – a $130 account increased to $12.000 in 30 days.

- 1923 – a $973 account increased to $30.000 in 60 days.

- 1933 – 479 trades were made with 422 being profitable. This is an accuracy of 88% and 4000% profit.

- 1946 – A 3-month net profit of $13.000 from starting capital of $4500 ~ 400% profit.

The following paragraph appeared in the December 1909 issue of “Ticket” Magazine. It was written by R.D. Wyckoff.

Richard Demille Wyckoff, commonly known as R.D. Wyckoff, was a prominent stock market analyst and trader. He was born in 1873 and became well-known for his expertise in technical analysis and the study of stock market trends.

Wyckoff is best remembered for developing a method of chart analysis known as the Wyckoff Method or Wyckoff Analysis, which focuses on understanding the intentions of large institutions and market manipulators by analyzing price and volume patterns.

Wyckoff started his career as a stockbroker and later founded the Magazine of Wall Street, where he shared his market insights and analysis with readers. Wyckoff describes Gann’s proficiency in projecting price targets forward in time:

“One of the most astonishing calculations made by Mr. Gann was during last summer (1909) when he predicted that September Wheat would sell at $1.20. This meant that it must touch that figure before the end of the month of September. At twelve o’clock, Chicago time, on September 30th (the last day) the option was selling below $1.08 and it looked as though his prediction would not be fulfilled. Mr. Gann said, ‘If it does not touch $1.20 by the close of the market, it will prove that there is something wrong with my whole method of calculations. I do not care what the price is now, it must go there. It is common history that September Wheat surprised the whole country by selling at $1.20 and no high in the very last hour of trading, closing at that figure”.

Gann’s trading methods are based on personal beliefs of a natural order existing for everything in the universe. Gann was part of a family with strong religious beliefs. As a result, Gann would often use Biblical passages as a basis for not only his life but his trading methods. A passage often quoted by Gann was from Ecclesiastes 1:9 – 10:

“What has been, that will be; what has been done, that will be done. Nothing is new under the sun. Even the thing of which we say, ‘See, this is new!”, has already existed in the ages that preceded us.”

This universal order of nature also existed, Gann determined, and we have the same opinion now, in the stock and commodity markets. Price movements occurred, not in a random manner, but in a manner that cat be pre-determined. The predictable movements of prices result from the influence of mathematical points of forces found in nature… And what is the cause for all these points of force?

Right… cosmos…universe…all planets around us.

This Gann could say at that time.

These points of force were felt to cause prices to not only move but move in a manner that can be anticipated. Future targets for both price and time can be confidently projected by reducing these mathematical points of forces to terms of mathematical equations and relationships.

The mathematical equations of Gann are not complex. They result in lines of support and resistance which prices invariably will follow.

Gann held that time is the most important element of trading. Time is the factor that determines the length of a commodity’s price trend. When time dictates that trending prices should react, prices may stabilize for a short period, or they may fluctuate within a tight range, but eventually, they will react by reversing direction.

Time is the element that will determine WHEN prices should react.

Certain price reactions are found to occur during specific times. The actual TYPE of price reaction can be anticipated, and pre-determined, by using Gann time rules.

Gann time periods last not only days or weeks but months and even years. Gann’s trading year is first divided in half, equivalent to 6 months or 26 weeks. The year is then divided by eighths, and then by sixteenths. And then, after you think you understand all of this, you find that Gann’s year is also divided by thirds.

There are also important time periods within the Gann year. For example, since a week is 7 days, and 7 times 7 is 49, Gann’s work found that 49 is a significant number too. Important tops or bottoms may occur between the 49th and 52nd day, although an intermediate change–in–trend may occur between the 42nd and 45th day because 45 days are 1/8 of a year.

Other time periods that were important to Gann, at which a price reaction could be expected, are:

- Anniversary dates of major tops and bottoms

- 7 months after a major top or bottom for a minor reaction.

- 10 to 14 days is the length of a reaction in a normal market. If this period is exceeded, the next reaction should be expected after 28 to 30 days.

If you’re not already confused, understand that Gann’s year may not only be calendar, but “fiscal” as well; starting from major tops or bottoms. Gann’s time rules consider many periods, including seasonality, Biblical references, and astronomical events.

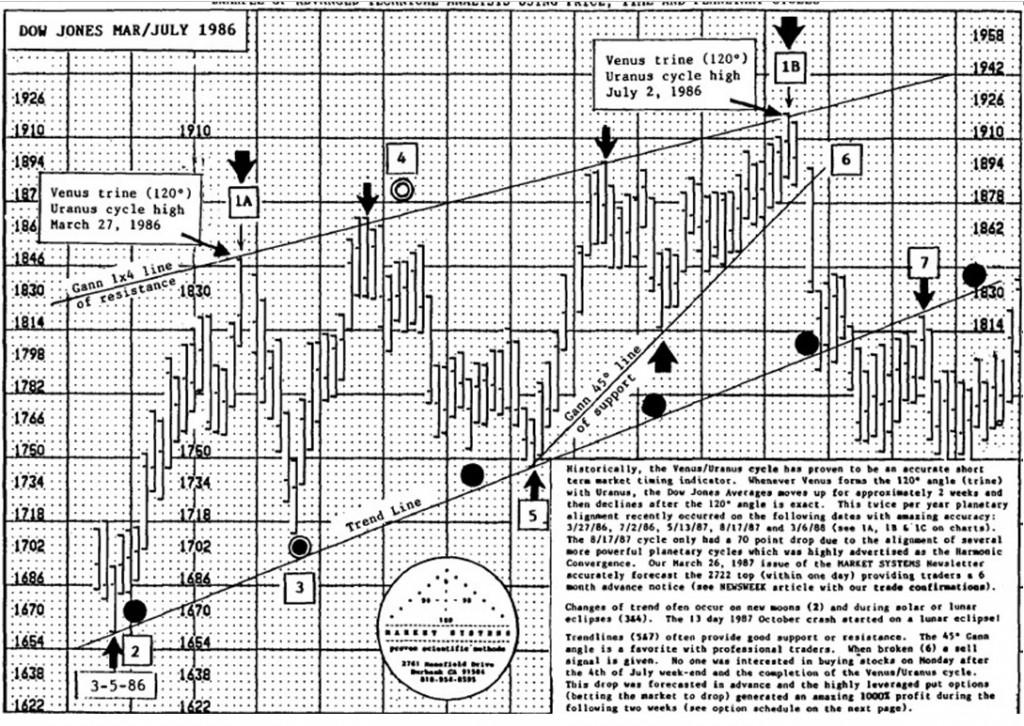

Let’s see a little example. This is an example of astronomical correlations on a Gann chart. One of Gann’s beliefs, stemming from his “natural order” concept, is the influence of planetary movements on earthly events, such as the moon’s perceived effect on tides.

This “cosmic perspective” of Gann is unlike conventional astrology, in those planetary influences, like units of price, are unique to each market.

Conclusions

Gann was a master of his time, a personality not easy to match any time soon. No matter what others say, his secrets have not been fully discovered yet.

Gann managed, with the methods of his time, and this is quite remarkable, to create an almost perfect system. After a general view, some might consider that his system is entirely based on technical analysis and numerology. At a closer look, we discover that Gann discretely refers numerous times to elements of astrology as an important part of his system.

Gann admitted one time, when talking about astrology, that he can not reveal all aspects of his work because people are not yet prepared for this kind of information. Talking about astrology as a method of financial analysis wouldn’t have been wise in the time of 1910-1930,

Nowadays society acknowledges the value of astrology as a science and appreciates it. This recognition is possible because of the hard work of many people that dedicated their life to researching this domain.

Gann had a complex system: the basis was astrology; at a higher level he used fundamental analysis and numerology; the outer layer was technical analysis. What remained to the successors was the outer layer. The depths are for those patient and courageous enough to walk his path.