How to execute trades based on this system

To do intraday trades based on this system,

You need to take the LTP of the index or stock after 9:05 AM i.e. the opening time in the morning!

Ideally, You should take the Weighted Average Price between 9:00 AM – 9:15 AM (Pre-market Range) because of volatility caused due to price discovery in the initial minutes.

However, after 9:30 AM, You can just take the LTP!

This is in the context of the Indian Share Market when the pre-market starts from 9:00 AM and the market starts from 9:15 AM.

This system is not developed by Gann. It merely shows a vague use case for the Gann Square of 9 Calculator with 22.5 degrees as a base.

How to Find Targets

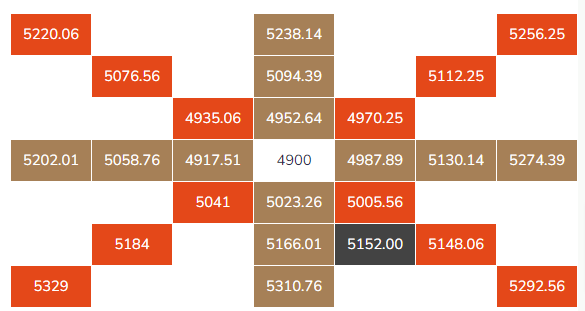

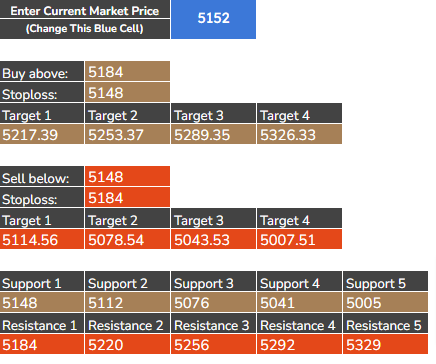

Once We are done making our Gann Square, We know the buy and sell levels from the support and resistances.

But how to find targets?

Use the same numbers as Pivots i.e. The resistance level will become a target if a buy trade is triggered.

The support level will become a target if a sell trade is triggered.

Keeping slight versatility, Let’s keep the Targets at 99.95% of resistance and 100.05% of support! So –

- Target for Buy Trade = Res * 0.9995

- Target for Sell Trade = Sup * 1.0005

So far, you have learned –

- The concept of Time frames in Gann Theory in the context of the construction of the Gann Squares.

- How to create a Gann Square of 9 calculator of Size 3 by using a base of 22.5 degrees to get Intraday Pivot Points.